|

Getting your Trinity Audio player ready...

|

In the wake of an outcry from small business owners, the Montrose Management District canceled its public meeting scheduled for Thursday with just a few hours' notice.

Alan Bernstein, a spokesman for the management district, said late Thursday morning that the 2 p.m. meeting was canceled due to the board’s inability to meet quorum requirements. Currently, the board is operating with only four board members.

Thursday’s meeting agenda included a vote on a slate of candidates to fill the board’s six vacant seats. With only four members currently on the board, a quorum of three members is required for a meeting to be held. Bernstein said two board members were no longer available for the meeting as of Thursday morning.

It’s the latest in a string of surprises springing up as the district attempts to revive itself following six years of silence.

Small business owners across Montrose believed the management district had been dissolved in 2018, following a board vote to do just that. But the district contends that dissolution was never completed. Now, after six years of inactivity, Montrose Management District is ready to swing back into action, funded by taxes levied on the businesses within its bounds.

Montrose business owner Daphne Scarbrough, who spoke against the proposed assessments at a City Council meeting Tuesday, said she believes the cancellation may be tied to the backlash from commercial property owners in recent weeks.

The outcry from business owners may have complicated the district's plans to “slip this thing under the door,” Scarbrough said.

“They know they're on thin ice,” Scarbrough said.

The management district has changed since its last incarnation, when it drew the ire of many small business owners who complained the tax was placing an undue burden on their shops and rental units.

To alleviate this strain, the district plans to tighten its taxation requirements. Businesses that operate out of an entrepreneur’s home are now exempt, as are any apartment complexes with 25 units or fewer. In total, Bernstein said, 996 commercial properties “appear to be subject to the district's annual assessment based on the information presently available.”

Despite the meeting's cancellation, which was posted on the district website, Scarbrough was one of a handful of business owners who showed up at 2 p.m. to see with her own eyes that the meeting was truly canceled.

“I don’t trust them,” said Scarbrough.

Judy Adams, the owner of Foelber Pottery on Richmond, echoed Scarbrough sentiments as she stood outside the meeting’s posted location.

“They’ve always done things on the sly,” said Adams, who had to step away from her shop during the middle of her business day for the occasion. “Why should we trust them now that this is going to be different?”

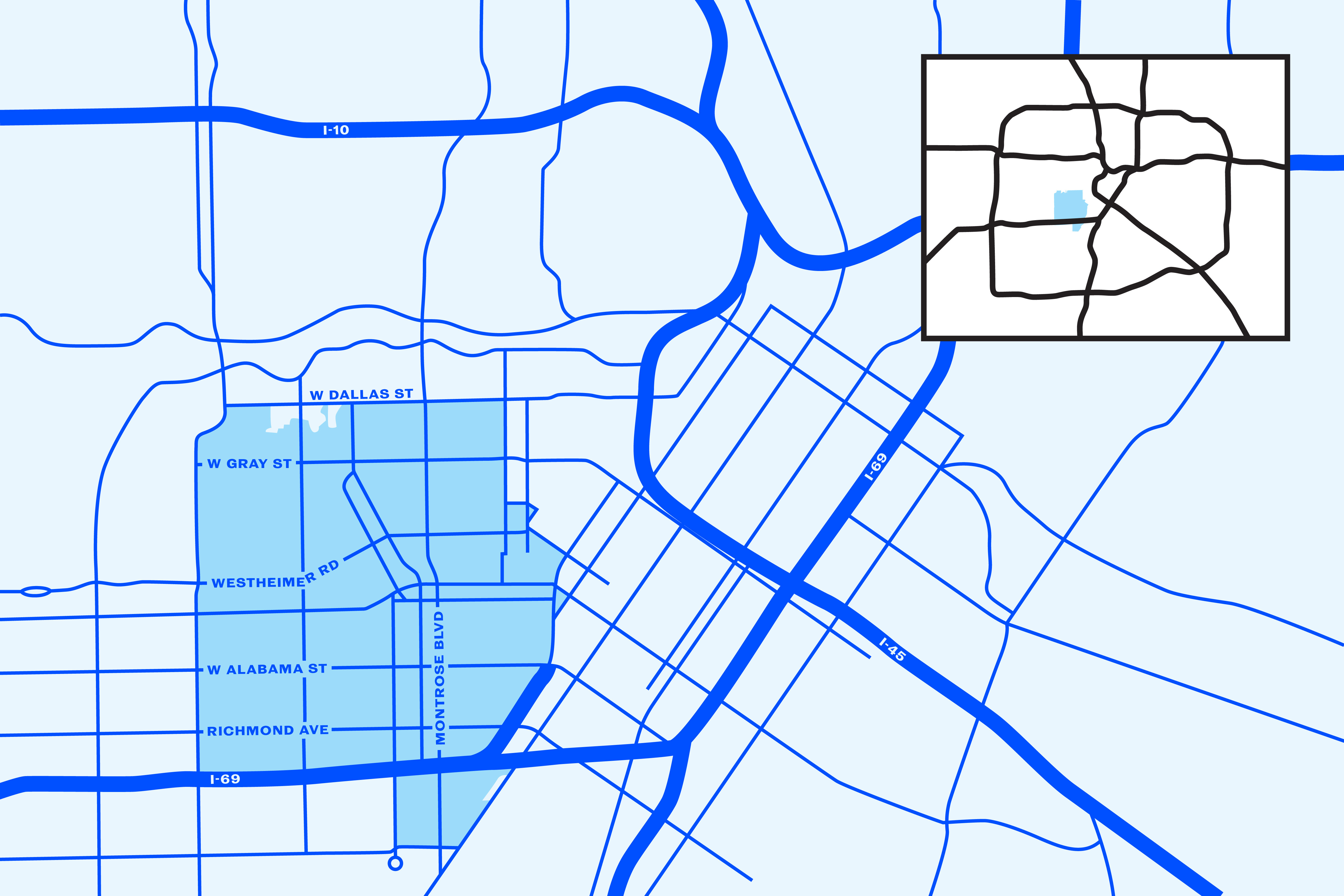

She lamented the meeting’s location, inside the building that houses the offices for Hawes Hill & Associates, the local consulting firm that serves as the district’s contract administrator — about a 25-minute drive from the heart of Montrose.

“This is why they put it here: Because it’s so hard to get to,” she said.

Bernstein said the Spring Branch location was chosen because Hawes Hill is able to use its own space, which is equipped with the proper tables and audiovisual equipment needed for board meetings without having to pay to rent a space — something the district simply cannot afford to do until its revenue begins flowing. Determining a new location within the Montrose business district was among the action items on the scrapped meeting’s agenda.

He further noted that Scarbrough business, which she runs out of her home, will no longer be subject to the district’s taxes.

Still, Scarbrough and another business owner who will not be subject to the district’s taxes under the revised rules, showed up “in solidarity” with neighboring businesses. That business owner, Pat Greer of Pat Greer’s Kitchen on West Clay, said she paid $14,000 in taxes already last year, and wouldn’t be able to accommodate the added burden of the management district’s taxes if she had to pay them.

Greer said she is “extremely thankful,” to be exempt from the tax, but “horrified it’s happening to the people in my neighborhood.” A neighborhood that, entrepreneurs note, has seen rapid appreciation in recent years.

Adams said her property taxes have “zoomed up thousands and thousands of dollars.” A Landing analysis of Harris Central Appraisal District data found that Adams’s property values soared by more than 45 percent between 2018 when the management district was last active, and her most recent assessment in 2023.

Thursday’s agenda included a vote to begin levying those taxes after a six-year hiatus. While the rate was set to decrease — from 12 cents per $100 of assessed value, to 9 cents — the rate of appreciation across Montrose means that many business owners, Adams included, could pay more under this new policy than they did nearly a decade ago.

The taxes are projected to fund $2.1 million in additional police patrols as well as graffiti and litter abatement initiatives in its first year. Over the next 15 years, the district plans to spend a total of $32.5 million.

In addition to the safety and beautification efforts, the district is also on the hook for $516,000 to settle a lengthy legal battle that sought to squash the district nearly a decade ago. It is still not clear what portion of the budget will cover that cost.

“I have a lot of questions,” Scarbrough said.

She’ll have to wait on the answers.

Bernstein said the district’s next meeting will be March 14, unless a special meeting is called sooner.