|

Getting your Trinity Audio player ready...

|

Don’t call it a comeback.

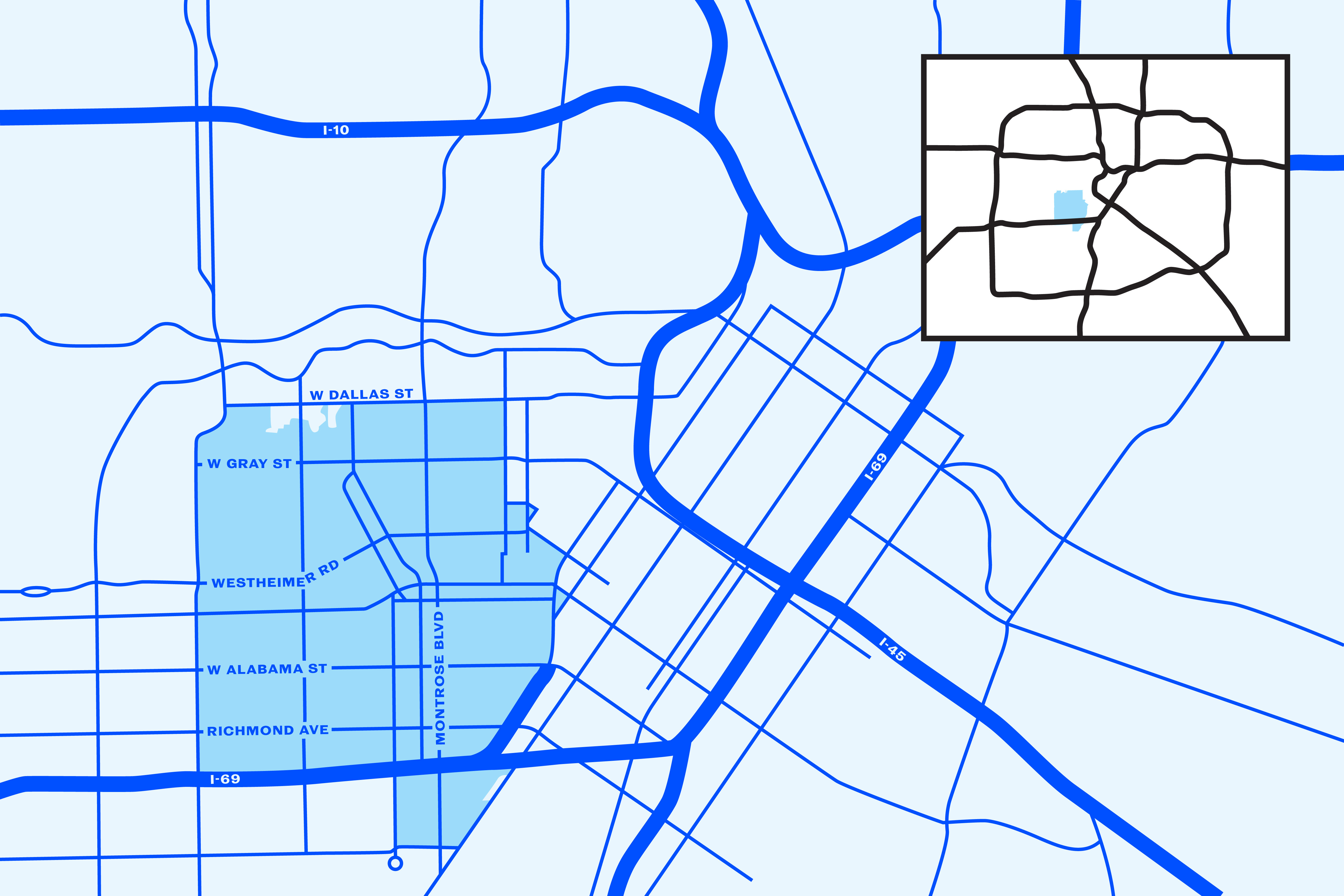

The Montrose Management District, which a decade ago drew protests and lawsuits from business owners angry about tax assessments, is set to vote Thursday on sending out new tax bills after years of dormancy.

Small business owners who thought they had killed off the district say they are shocked.

District officials backed by luxury apartment building owners, however, say it never went away and remains eager to provide police patrols and other services at a lower rate than before.

“We want to make sure that Montrose is safe and clean and walkable,” said Josh Hawes, a partner at Hawes Hill & Associates, a local consulting firm that serves as the contract administrator for the Montrose Management District and many others across the city.

In its first year, the district hopes to spend $2.1 million collected from local businesses to boost public safety, fight graffiti and beautify the neighborhood.

Also on the to-do list, but not in the district’s public plan: a $516,000 payment to settle the legal battle that nearly doomed the district in the first place.

A long fight

That courtroom fight started in 2012, after a faction of Montrose business owners got up in arms about the district’s tax assessments.

Municipal management districts are created via petitions from business owners and rely on funds from special tax assessments. Designed to fill gaps in city services and spur economic development, they have drawn praise from some neighborhood leaders, and skepticism from others who see them as undemocratic and unaccountable.

Like the dozens of other districts that cover swaths of Houston and beyond, the Montrose Management District is a creation of the Texas Legislature. Former state Rep. Garnet Coleman sponsored a bill authorizing the district in 2005.

During its previous incarnation, the district levied a 12-cent tax on every $100 of assessed value — a rate that angered small business owners who complained they were being double-dipped for taxes they could not afford. There also were complaints the district was not living up to its pledge to provide extra security and spruce up the neighborhood.

Private homes generally are excluded from the assessment. The first iteration of the district, however, included the owners of small apartment buildings.

Property owner Bob Rose filed a series of lawsuits through a company he owned alleging the district relied on invalid petitions and that its tax collections should be returned to their owners. The lawsuits dragged on for years. Outside court, business owners collected petitions seeking to formally dissolve the district.

Then, in March 2018, the board took a vote the aggrieved business owners thought spelled the end of the district. At that meeting, it was widely reported, the district’s board voted itself out of existence.

Hawes insists that reports of the district’s death, which included a declaration from the district’s then-managing director that the board “made the decision to move forward with the dissolution” that March, have been greatly exaggerated.

A decade ago, Daphne Scarbrough, the owner of a custom metal fabrication shop called the Brass Maiden, helped collect three rounds of petitions from business owners seeking to have the district dissolved. She celebrated at what she thought was its final board meeting.

“I was happy that the board did vote. They lie about that now,” she said.

As it turns out, the vote was conditional. The board voted to dissolve itself only upon a judge’s declaration that it could dissolve itself and that it had a sufficient plan to pay off its debts.

Those conditions were never met, according to the district. In May 2019, the district reached an agreement with Rose’s company that settled his pending cases. Under its terms, the district is required to reimburse legal fees and to exempt eight properties from future assessments.

Back in business

By the end of 2017, the district listed a paltry $11,000 in its bank account. The district has a plan for paying the settlement and covering its projected $2.1 million annual budget, however.

All management districts operate under a service plan, which includes the assessment of commercial properties and levying a district tax that is used to fund issues of pressing interest to that district’s business community.

Going forward, Montrose business owners will be taxed at the rate of 9 cents per every $100 in assessed value.

Though lower than the 12 cents per $100 in value rate that previously drew business owners’ ire, many will not catch a break because of the rapid appreciation of property values across Montrose in the post-Harvey years.

Under a draft budget, the district expects to spend $32.5 million during the next 15 years. The highest percentage would go toward public safety and security, at 60 percent, followed by 15 percent for administration, 10 percent for maintenance and beautification, 10 percent for economic development and a 5 percent reserve fund.

The district’s wish list includes patrols from off-duty law enforcement officers or private security, automatic license plate readers, graffiti abatement and added street lighting.

So far, the district’s public documents have not disclosed the $516,000 legal settlement. Pressed by the Landing about the settlement’s absence from public budget plans, Hawes said that could be corrected in the days to come.

“The budget is going to be revised as there are some possible changes in caps on certain valuations on apartments that might be voted in at the next board meeting,” he said. “If you look at the document, the payment is split over two years, and we will be taking that into account. Yes, it means we won’t have as much for services this year but at least we can start the services.”

The district’s current board is operating with only four members who are holdovers from 2018, with plans to flesh out its full membership to 10 in the coming weeks. As the board awaits the installment of its full slate, which must be approved by the mayor, Hawes contends that any actions taken only require a majority of current members – just three votes.

If Montrose business owners hope to launch another lawsuit against the district, they could face a roadblock. The district has collected dozens of new petitions from business owners to authorize its activities.

Some of the petitions date from late 2017, when the district was fending off lawsuits.

More recent petitions show support from the owners of the towering apartment complexes that have sprouted in Montrose since that battle. That includes the owners of the Residences at La Colombe D’Or, the Driscoll at River Oaks and the apartments planned for the corner of Montrose and Westheimer by the developer Skanska.

While small business owners will see their properties’ full value assessed, large apartment complex owners will receive some relief. They will be assessed based on an average of four stories, rather than the full height of the building.

The district’s service plan also excludes single-family properties that double as the headquarters for small businesses, along with apartment buildings with 25 units or fewer.

Local opposition

Councilmember Abbie Kamin, whose District C includes Montrose, said she will be watching the district's revival closely.

“Historically, the Montrose Management District was plagued with issues that residents raised. My hope is that the new board has taken note of that, and will turn the page for a new chapter that will benefit the entire area. Neighborhood and residential and business engagement will be a critical component of that,” she said.

The district’s promises — and its level of community engagement thus far — do not impress Anastasia Malavansos, the landlord of several small businesses near the intersection of Westheimer and Woodhead.

“I never saw what they did. I mean, if you look at when we have them versus when we don't have them — there is no difference in crime,” she said. “If I thought there was value in it, I wouldn't mind paying.”

City councilmember Abbie Kamin:

“Historically, the Montrose Management District was plagued with issues that residents raised. My hope is that the new board has taken note of that, and will turn the page for a new chapter that will benefit the entire area.”

Malavansos said she expects to see a higher bill despite the lower assessment rate. When the bill comes, she says, many property owners will be forced to pass it along to tenants.

Mayor John Whitmire “is going to listen to the residents and their concerns and questions,” Mary Benton, director of the Mayor’s Office of Communications, wrote in an email Friday.

Hawes said he understands those who followed the saga in the 2010s will be surprised by the district’s decision to “implement a new service plan.” That phrasing, he said, is the best language for what’s currently happening, since in his view the district itself never went away.

Back in 2018, the board of directors hired a public relations firm that advised the district to “stay silent,” Hawes said.

“So, the message that went out was completely wrong, because the management district wasn’t giving their side, wasn’t saying what was going on.”

Recently, pressure has mounted to revive the district, in large part to promote the work being proposed by a special tax area in Montrose, Tax Increment Reinvestment Zone 27, which is at the center of a thorny issue surrounding the replacement of a swath of trees along Montrose Boulevard. By law, such zones can implement infrastructure projects, but cannot maintain them.

That means TIRZ 27 can plant the new trees to replace the old ones, but cannot maintain them. That maintenance would require a management district.

“Like I said, the TIRZ has been wanting (the management district), and the TIRZ is a function of the city, so, therefore, the city has been wanting it, so that way the TIRZ can do its job,” Hawes said.